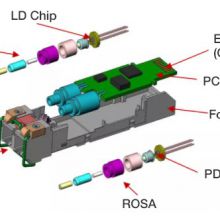

1. Introduction of optical moduleAs an important part of fiber optic communication, optical module is an optoelectronic device that realizes the function of photoelectric conversion and electro-optical conversion. To be precise, optical module is the general name of several types of modules, including optical transmitting module transmitter, optical receiving module receiver, optical transceiver module transmitter and optical forwarding module transmitter. Generally, the optical module we call generally refers to the integrated optical transceiver module, namely, optical transceiver. ① Working principle of optical transceiver Optical transceiver works in the physical layer of OSI model and is one of the core devices in optical fiber communication system. It is mainly composed of optoelectronic devices (optical transmitter, optical receiver), functional circuit and optical (Electrical) interface. Components of an optical transceiver Basic principle: the transmitting interface inputs an electrical signal with a certain code rate. After being processed by the internal driving chip, the driving semiconductor laser (LD) or light emitting diode (LED) emits a modulated optical signal with a corresponding rate. After being transmitted through the optical fiber, the receiving interface converts the optical signal from the optical detection diode into an electrical signal, After passing through the preamplifier, the electrical signal of the corresponding code rate is output. ② Key parameters of optical transceiver The key technical indicators of the optical transceiver mainly include: transmitting optical power, receiving optical power, overload optical power, maximum receiving sensitivity and extinction ratio. A. Transmitting optical power: refers to the optical power output by the light source at the transmitting end of the optical module under normal working conditions, which can be understood as the intensity of light, and the unit is w or MW or DBM. Where w or MW is the linear unit and DBM is the logarithmic unit. In communication, we usually use DBM to represent optical power, and the optical power of 0dbm corresponds to 1MW.B. Receiving optical power: refers to the average optical power range that can be received by the receiving end component under the condition of a certain bit error rate (BER = 10-12). The upper limit value is the overload optical power, and the lower limit value is the maximum value of reception sensitivity.C. Overload optical power: also known as saturated optical power, it refers to the maximum input average optical power that can be received by the receiver component when a certain bit error rate (BER = 10-12) is maintained at a certain transmission rate (unit: DBM). It should be noted that the photocurrent saturation of the photodetector will occur under strong light irradiation. Therefore, strong light irradiation should be avoided as far as possible to prevent exceeding the saturated light power.D. Receiving sensitivity: refers to the minimum average input optical power that can be received by the receiving end component when a certain bit error rate (BER = 10-12) is maintained at a certain transmission rate (unit: DBM). Generally, the higher the rate, the worse the reception sensitivity, that is, the greater the minimum received optical power, and the higher the requirements for the receiving devices of the optical transceiver.E. Extinction ratio (EXT): it is one of the important parameters used to measure the quality of optical modules. It refers to the ratio of the optical power P1 (when the laser emits all "1" codes) to P0 (when the laser emits all "0" codes) under the condition of full modulation, and the unit is dB. It is not that the greater the extinction ratio, the better the quality of the optical module, but that the optical module with an extinction ratio can meet the IEEE 802.3 standard is the better. ③ Example of optical transceiver information on the switch: Cisco switch interface optical transceiver information: Huawei switch interface optical transceiver information:2. Classification and packaging(form-factor) of optical transceivers ① Transmission rate: The current common types of optical modules are as follows:400GE optical module200GE optical module100GE optical module40GE optical module25GE Optical Module10GE Optical ModuleGE Optical ModuleFE Optical Module ② Form-factors: The higher the transmission rate, the more complex the structure, resulting in form-factors. For example, SFP/eSFP, SFP+, SFP28, QSFP+, CXP, CFP, QSFP28, etc. l SFP (Small Form-factor Pluggable) optical module: small pluggable SFP module supports LC fiber connector.l SFP + (Small Form-factor Pluggable plus) optical module: refers to the SFP module with increased rate. Because of the increased rate, it is sensitive to EMI and smaller than the SFP module.l XFP (10GB Small Form-factor Pluggable) optical module: "X" is the abbreviation of Roman numeral 10. All XFP modules are 10GE optical modules. The XFP optical module supports LC optical fiber connectors. Compared with SFP + optical module, XFP optical module is wider and longer in size.l SFP28 (Small Form-factor Pluggable 28) optical module: the interface package size is the same as that of SFP +, and supports 25G SFP28 optical module and 10G SFP + optical module.l QSFP+ (Quad Small Form-factor Pluggable) optical module: four channel small hot pluggable optical module. QSFP + optical module supports MPO optical fiber connector, which is larger than SFP + optical module. Fiber Mall 40G QSFP+ Optical Transceivers l CXP (120 GB/s Extended Capability Form-factor Pluggable) optical module: it is a hot-pluggable high-density parallel optical module standard. It provides 12 channels in the transmit and receive (TX / Rx) directions. It is only applicable to short-range multimode links.l CFP (CENTUM Form-factor pluggable) optical module: the size is defined as 144.75mm × 82mm × 13.6mm, which is a new optical module standard with high speed, hot-pluggable and supporting two applications of data communication and telecommunication transmission.l QSFP28 (Quad Small Form-factor Pluggable 28) optical module: the interface package size is the same as QSFP+, and supports 100G QSFP28 optical module and 40G QSFP+ optical module. ③ Single-mode or muti-mode? The optical fiber is divided into single-mode optical fiber and multi-mode optical fiber. The single-mode optical module is used together with the single-mode optical fiber. The single-mode optical fiber has wide transmission frequency bandwidth and large transmission capacity, which is suitable for long-distance transmission; The multi-mode optical module is used together with multi-mode optical fiber, and multi-mode optical fiber has mode dispersion defect, and its transmission performance is worse than that of single-mode optical fiber, but the cost is low. Therefore, it is suitable for small capacity and short-distance transmission. ④ Wavelength The central wavelength refers to the waveband used for optical signal transmission. At present, there are three kinds of common central wavelengths: 850nm, 1310nm and 1550nm.850nm: mostly used for short distance transmission (≤ 2km)1310nm and 1550nm: mostly used for medium and long distance transmission (>2km) ⑤ Transmission distance According to the different transmission distance of optical module, it can be divided into:Short distance optical module: ≤ 2kmMedium distance optical module, 10 ~ 20kmLong distance optical module: ≥30km.The transmission distance of optical modules is limited mainly because of the loss and dispersion of optical signals during fiber transmission. ⑥ Photoelectric module The photoelectric module is usually called electric port module or RJ45 SFP module. Unlike the optical module, the electric port module does not carry out photoelectric conversion. Through the switching of the electric module, the two optical interfaces can be connected with a network cable.RJ45 Copper SFP Module 3. Development and evolution of optical transceiversIn the current physical architecture network of mainstream data centers, Spine-Leaf (Clos network architecture) architecture is commonly followed. Usually 10GE interface is used as the access side server docking, and 40GE interface is commonly used for the uplink on the Leaf side. In large data centers, it has been common to use 25G as the mainstream access and 100G uplink. In scenarios requiring high computation and high bandwidth, GPU servers have been using 100GE and even 200GE access. Data center switch interconnects are evolving to large-scale 400GE interconnects.The development of Ethernet has undergone rapid changes from 1Mbit/s, 10Mbit/s, 100Mbit/s (FE), 1Gbit/s (GE), 10Gbit/s (10GE) to 40Gbit/s (40GE), 100Gbit\s (100GE), and with the rapid development of big data, smart cities, mobile Internet, cloud computing, network traffic has shown exponential growth. The thirst for continuous growth of bandwidth will require higher bandwidth rates, and optical modules will develop rapidly.

Fiber Optic Transceivers Optical Module Fiber Optic 2668 81 07/29/21RECENT POSTS

HONG KONG, April 23, 2024 /PRNewswire/ -- Today, the Huawei Cloud Summit Hong Kong, themed "Leap to Intelligence", brought together more than 500 prominent figures including government leaders, industry experts, business leaders, and partners to dive into technological innovation, industry practices, and ecosystem development. In addition to showcasing key products and technologies such as Pangu models, Ascend AI Cloud Service, GaussDB, and data-AI convergence, Huawei Cloud also unveiled CloudPond and the Hong Kong AI Acceleration Program in an effort to build Hong Kong into a global AI industry highland. Jacqueline Shi, President of Huawei Cloud Global Marketing and Sales Service, said in her remarks that Huawei's three-decade accumulation of ICT technologies, innovation, and expertise is now open to Hong Kong as their launchpad towards intelligence with better technologies, industry solutions, and ecosystem resources. Jacqueline Shi, President of Global Marketing and Sales Service, Huawei Cloud Ir. Tony Wong, JP, Government Chief Information Officer of Hong Kong SAR, stated that The Hong Kong SAR has been committed to giving full play to cloud computing in smart government and smart city. Launched in September 2020, the next-generation Government Cloud Infrastructure Services (GCIS) leverage a secure, stable private cloud and a new application system architecture to facilitate government departments in developing e-gov services at ease and lower costs. Fostering an AI industry ecosystem is also very important to Hong Kong's future. We expect to witness brand-new AI cloud services from Huawei, a leader in the AI realm, propel AI R&D and industry development and ultimately benefit the people of Hong Kong. Ir. Tony Wong, JP, Government Chief Information Officer, Hong Kong SAR, China According to Mark Chen, President of Huawei Cloud Solution Sales, to turn Hong Kong into a global hub of innovation and technology, Huawei Cloud has packaged leading technologies and best practices into three "Natives": Cloud Native, which a solid cloud foundation; AI Native, which unleashes digital productivity; and Ecosystem Native, which brings the industry together. Mark Chen, President of Huawei Cloud Solution Sales Cloud Native: A Solid Cloud Foundation Huawei Cloud now has 88 AZs in 30 geographical Regions with KooVerse, its global cloud infrastructure. It is the only cloud vendor to deploy a 4-AZ data center in Hong Kong, offering top-notch security and stability for customers, not to mention the 9 ms ultra-low latency. Customers now have more options to go cloud as Huawei Cloud has extended to wherever needed through its full-fledged distributed cloud infrastructure, including dedicated cloud, Huawei Cloud Stack, and CloudPond. This is the first time CloudPond is known to the world. Designed with a "One CloudPond, All Cloud Services" concept, CloudPond is an edge service that extends the public cloud to customer premises, featuring cloud-edge collaboration, local data storage, and high stability desired for use cases in smart manufacturing, unmanned driving, and remote diagnosis scenarios. Huawei Cloud Stack, now in version 8.3, provides six highlights: one solid cloud foundation and five innovations covering databases, mainframe modernization, data lakes, AI models, and industrial Internet. Envisioning the wider adoption of cloud, Huawei Cloud also launched a "Leap2Cloud" initiative to help more customers and partners in Hong Kong bid farewell to virtualization and embrace the cloud. Hu Yuhai, Vice President of Huawei Hybrid Cloud, announcing Huawei Cloud Stack 8.3 To ensure network and service stability, Huawei Cloud has SRE centers across the world, translating the inherent uncertainty in rapid business growth into a deterministic SLA for customers. This effort is represented by an SLA of over 99.99% for major Huawei Cloud services. As William Fang, Huawei Cloud Chief Product Officer said, no industry is spared from digitalization and intelligence. The key to navigating this change is to make the most of cloud. AI Native: Unleashing Digital Productivity Huawei Cloud has injected systematic innovation to power Hong Kong's digital intelligence from three dimensions. First, Pangu models adopt a three-layer "5+N+X" architecture to provide not just general capabilities, but also industry-tailored capabilities especially for government, media, finance, and retail. Second, an AI cloud service that can be used right out of the box provides stable and reliable AI compute to power efficient model training and inference. This service also includes a full-link cloud-based toolchain to support migration and development. Additionally, Huawei Cloud offers a dedicated zone of foundation models optimized for Ascend Cloud, enabling users to quickly build applications on AI models. Last but not least, there is no AI without data. GaussDB, a next-generation AI-native distributed database that excels at high availability, security, performance, scalability, and intelligence, allows for a smarter way for database deployment and migration, and greatly improves data processing for AI applications to run smoothly. Huawei Cloud also employs AI to process data, thereby feeding higher-quality data for AI models. Huawei Cloud works with local organizations and enterprises to develop foundation models and AI applications to suit local needs. With Huawei Cloud's diverse, efficient, and stable computing power, HKGAI has achieved a significant milestone in AI innovation in Hong Kong by developing the first foundation model trained in the region. According to Hong Kong Observatory, Huawei Cloud's Pangu Weather Model extends the forecast period of computer model weather forecasts from ten to fifteen days. Huawei Cloud published Hong Kong Finance White Paper with PwC, propelling financial security compliance, innovation, and steady growth in Hong Kong. Ecosystem Native: Better Together A digital industry ecosystem thrives only with joint efforts. Huawei Cloud will work with industry partners such as Cyberport Hong Kong to establish an AI industry cloud platform and AI enablement center in Hong Kong to upskill partners. Talent is a must for AI transformation. At this summit, Huawei Cloud announced the Hong Kong AI Acceleration Program which aims to support 100+ enterprises for AI innovation in the next three years. William Dong, President of Huawei Cloud Marketing Good technologies are a social good. At this summit, William Dong, President of Huawei Cloud Marketing, shared how Huawei Cloud technologies have helped detect rare diseases, protect the rainforest in Sarawak, Malaysia, and predict extreme weather. Mr. Dong proposed the "Cloud for Good" initiative, calling for concerted efforts from customers and partners from Hong Kong and beyond to promote digital inclusion and a better world with cloud and AI.

HANGZHOU, China, April 23, 2024 /PRNewswire/ -- The China Pavilion at the 60th International Art Exhibition (La Biennale di Venezia) organized by Ministry of Culture and Tourism of the People's Republic of China, embraces the theme "Atlas: Harmony in Diversity," curated by Wang Xiaosong and Jiang Jun. It is structured into two sections: "集 (Collect)," showcasing imagery archives sourced from "A Comprehensive Collection of Ancient Chinese Paintings," and "传 (Translate)," spotlighting works by seven Chinese contemporary artists: Che Jianquan, Jiao Xingtao, Qiu Zhenzhong, Shi Hui, Wang Shaoqiang, Wang Zhenghong, and Zhu Jinshi. Theme of the China Pavilion—Atlas: Harmony in Diversity The China Pavilion embraces "Atlas: Harmony In Diversity" as its theme, with a focus on the concepts of gathering, exchanging, and integrating, aiming to convey the values of embracing inclusivity, coexistence in unity, and shared beauty with diversity from traditional Chinese culture. In particular, "atlas" symbolizes the convergence of diverse identities, races, beliefs, ideas, purposes, backgrounds, and cultures worldwide, fostering opportunities for dialogue, communication, and mutual understanding. In "Collect," digital archives of 100 Chinese paintings scattered overseas will be displayed in archive cabinets and on LED screens. These works are part of "A Comprehensive Collection of Ancient Chinese Paintings," a project spanning 19 years and comprising 12,405 pieces/sets of ancient Chinese painting treasures, over 3,000 of which are housed in institutions outside China, accounting for a quarter of the total works recorded. Meanwhile, "Translate" features seven Chinese contemporary artists who engage in new creations inspired by the "A Comprehensive Collection of Ancient Chinese Paintings," exploring various traditional Chinese painting elements, encompassing architecture, landscapes, figures, and flora and fauna. This not only reflects the cultural amalgamation of traditional Chinese literati but also emphasizes the inheritance bridging tradition and contemporary art. Between "Collect" and "Translate," the exhibition draws inspiration from "Mnemosyne Atlas" by 20th-century German art historian Aby Warburg, using image documentation to compile thematic plates for each artwork. It seeks to forge a connection between traditional Chinese paintings and contemporary art through the juxtaposition of diverse images, while also resonating with global image history, creating a dual linkage between Chinese and foreign, past and present. The exhibition is scheduled to run from April 20 to November 24, 2024 (with a preview held from April 17 to 19) at the Arsenale in Venice, Italy.

Watsons honored as Organization of the Year FAIRFAX, Va., April 23, 2024 /PRNewswire/ -- The Stevie® Awards, organizer of the world's premier business awards programs, announced the winners of five Grand Stevie® Award trophies in the 11th annual Asia-Pacific Stevie® Awards, the only awards program to recognize innovation in the workplace throughout the Asia-Pacific region. Gold, Silver, and Bronze Stevie Award winners in various categories were announced on 10 April. Those awards were determined by the average scores of more than 150 executives worldwide acting as judges. The 2024 Asia-Pacific Stevie Awards have recognized organizations in 25 markets including Australia, Cambodia, mainland China, Hong Kong SAR, Estonia, India, Indonesia, Japan, Korea, Malaysia, New Zealand, Philippines, Singapore, Taiwan, Thailand, the United Kingdom, the United States, and Vietnam. The Grand ("best of show") Stevie Award trophy is awarded to only a handful of organizations in each of the nine Stevie Awards competitions. In the Asia-Pacific Stevie Awards, one Grand Stevie Award is presented to the most honored organization, and one each to the highest-scoring nomination from the four markets that submitted the most nominations. The prestigious Grand ("best of show") Stevie Award trophy has been given to five winning organizations in the 2024 Asia-Pacific Stevie® Awards. Watsons of Hong Kong was the most honored Grand Stevie Award winner, and the Grand Stevie Award winners with the highest-scoring nominations from the four markets with the most nominations in the competition are Farmbot Monitoring Solutions, Beijing apm, IntouchCX, and Shell companies in the Philippines (SciP). The 2024 Grand Stevie Award for Most Honored Organization of the Year goes to Watsons, headquartered in Hong Kong, with 72.5 award points. This award could not be applied for directly. The award is determined by a points system based on the total number of awards won in the competition, with a Gold Stevie win counting for 3 points, a Silver Stevie for 2 points, and a Bronze Stevie counting for 1.5. The Grand Stevie Awards presented to the highest-scoring nomination from each of the four markets that submitted the most nominations to the competition are: From Australia: Farmbot Monitoring Solutions, of Roseville, New South Wales, for their "Farmbot Pump Control – Innovating Water Management for Agriculture" nomination, a Gold Stevie Award winner for Innovation in Digital Transformation, with an average score of 9.00/10. From China: Beijing apm, nominated by Brand Head, winner of a Gold Stevie for their nomination "A 'healing' mall other than a 'shopping" mall' for Innovation in Consumer Events (8.86/10). From India: IntouchCX, Hyderabad, for their Most Innovative Customer Service Team nomination, a Gold Stevie winner in that category, average score 8.67. From the Philippines: Shell companies in the Philippines (SciP), Marikina City, for their nomination "Empowering farmers, enriching communities: the transformative impact of Pilipinas Shell Foundation, Inc.," which won a Gold Stevie for Innovation in Community Relations or Public Service Communications, with an average score of 9.33/10. Winners in the 2024 Asia-Pacific Stevie Awards will be celebrated during an awards banquet on 24 May at Shangri-La The Fort Hotel in Manila, Philippines. Tickets for the awards banquet are on sale now. PR Newswire Asia is the official news release distribution partner of the 2024 Asia-Pacific Stevie Awards. adobo magazine is the official Creative Media Partner of the 2024 Asia-Pacific Stevie Awards. About the Stevie Awards Stevie Awards are conferred in nine programs: the Asia-Pacific Stevie Awards, the German Stevie Awards, the Middle East & North Africa Stevie Awards, The American Business Awards®, The International Business Awards®, the Stevie Awards for Great Employers, the Stevie Awards for Women in Business, the Stevie Awards for Sales & Customer Service, and the newest Stevie Awards program, the Stevie Awards for Technology Excellence. Stevie Awards competitions receive over 12,000 entries annually from organizations in more than 70 nations. Honoring organizations of all types and sizes and the people behind them, the Stevies recognize outstanding performances in the workplace worldwide. Learn more about the Stevie Awards at http://www.StevieAwards.com. Contact:Nina Moore+1 (703) 547-8389Nina@StevieAwards.com

HONG KONG and SHANGHAI, April 23, 2024 /PRNewswire/ -- Ping An Insurance (Group) Company of China, Ltd. (hereafter "Ping An," the "Company" or the "Group," HKEX: 2318; SSE: 601318) today announced its first quarter financial results for the three months ended March 31, 2024. China's economy gradually recovered in the first three months of 2024, with capital markets picking up. However, there were still growth challenges including insufficient demand and weak economic expectations. Amidst opportunities and challenges, Ping An focused on core financial businesses and strengthened the insurance protection function to serve the real economy under its business policy of "focusing on core businesses, boosting revenue and cutting costs, optimizing structure, and enhancing quality and efficiency". Following the technology-driven "integrated finance + health and senior care" strategy, Ping An continuously consolidated its integrated finance advantages, remained customer needs-oriented, and pursued high-quality development. The Group's operating profit attributable to shareholders of the parent company reached RMB38,709 million. Three core businesses, namely Life & Health, property and casualty insurance, and banking, resumed growth and delivered RMB39,816 million in operating profit attributable to shareholders of the parent company, up 0.3% year on year. Life & Health showed significant growth momentum. Life & Health NBV amounted to RMB12,890 million in the first three months of 2024, up 20.7% year on year on a like-for-like basis. NBV per agent climbed 56.4% year on year. Ping An continued to develop its integrated finance model. Retail customers increased 1.0% from the beginning of the year to nearly 234 million and contracts per retail customer reached 2.94 as of March 31, 2024. Ping An continued to implement its health and senior care ecosystem strategy. The Company achieved nearly RMB40 billion in health insurance premium income in the first three months of 2024. Customers entitled to service benefits in the health and senior care ecosystem contributed about 70% of Ping An Life's NBV in the first three months of 2024, up 6 pps year on year. Life & Health achieved double-digit growth in NBV, and enhanced strength in channels. Ping An Life furthered the "4 channels + 3 products" strategy and achieved outstanding performance in key business operating indicators. Ping An Life achieved steady business development thanks to comprehensive advancement in sales channels, improved business quality, and diverse products and services launched. Life & Health NBV amounted to RMB12,890 million in the first three months of 2024, up 20.7% year on year on a like-for-like basis. NBV margin was 22.8%, up 6.5 pps year on year on a like-for-like basis. From January to March 2024, Life & Health realized premium income of RMB185,346 million, an increase of 1.2% year on year, leading the industry in terms of scale, and continuing to improve its operating trend. In respect of channels, under the value proposition of high-quality development, Ping An Life continued to deepen the transformation and build multi-channel professional sales capabilities, significantly improving the development quality. Ping An Life improved the business quality of the agent channel, and continuously increased team productivity by recruiting high-quality agents through high-quality existing ones. NBV per agent climbed 56.4% year on year in the first three months of 2024, and the proportion of "Talent +" new agents increased by 11.0 pps year on year. Ping An Life furthered the exclusive agency model with Ping An Bank, and continuously expanded partnership with high-quality external banks. In addition, Ping An Life standardized outlet operations, and continuously boosted operational efficiency. Overall policy persistency ratio of all retained customers in the cities with Community Grid outlets improved by 2.5 pps year on year as of March 31, 2024. In respect of products, Ping An Life continued to focus on three areas, namely wealth management, pension insurance, and protection insurance, meeting customer needs for diverse insurance products. By leveraging the Group's health and senior care ecosystem, Ping An Life built differentiated advantages by enhancing its three core services: health care, home-based senior care and high-end senior care. In respect of health care, Ping An Life provided health management services to over 10 million customers in the first three months of 2024. Ping An's home-based senior care services covered 54 cities across China, and nearly 100,000 customers qualified for the home-based senior care services as of March 31, 2024. Ping An established the "Ping An Concierge Senior Care Service Alliance" jointly with partners and released the "5-7-3 Home Safety Renovation Service" in March 2024 to help seniors improve their quality of life. In respect of high-end senior care, Ping An has unveiled high-end senior care projects in Shenzhen, Shanghai, Hangzhou and Foshan. Ping An continuously advanced its integrated finance strategy, maintained steady growth in P&C and banking businesses, and delivered stable return in insurance funds investment. Ping An provided "worry-free, time-saving, and money-saving" one-stop integrated finance solutions under a customer-centric philosophy. Retail customers increased 1.0% from the beginning of the year to nearly 234 million and contracts per retail customer reached 2.94 as of March 31, 2024. Retail customers and contracts per retail customer have increased 17.9% and 10.1% respectively since December 31, 2019. Ping An P&C maintained stable business growth and healthy business quality. Ping An P&C's insurance revenue rose by 5.7% year on year to RMB80,627 million in the first three months of 2024. Overall COR rose by 0.9 pps year on year to 99.6%; COR excluding guarantee insurance was 98.4%, up year on year mainly due to snowstorms on early days of the Chinese New Year and increased customer travels. The snowstorms adversely impacted COR by 2.0 pps in the first three months of 2024. Ping An Bank maintained steady business performance and stable asset quality. Ping An Bank improved operational cost-effectiveness via digital transformation, strengthened asset quality control and management, and enhanced non-performing asset recovery and disposal. Net profit grew by 2.3% year on year to RMB14,932 million. Non-performing loan ratio was 1.07% and provision coverage ratio was 261.66% as of March 31, 2024. Ping An Bank's capital adequacy ratios at all levels met regulatory requirements, and its core tier 1 capital adequacy ratio rose to 9.59% as of March 31, 2024. Insurance fund investment returns performed well and the portfolio steadily increased. The Company's insurance funds investment portfolio achieved an annualized comprehensive investment yield of 3.1%, and an annualized net investment yield of 3.0% in the first three months of 2024. The Company's insurance funds investment portfolio grew 4.4% from the beginning of the year to more than RMB4.93 trillion as of March 31, 2024. The Company is committed to creating stable investment incomes through macroeconomic cycles, and meeting liability needs under a liability-driven approach, taking solvency as a core metric. Further developing the health and senior care ecosystem as a new driver of value growth. Ping An's health and senior care ecosystem created both standalone direct value and huge indirect value by empowering our core financial businesses through differentiated "Product + Service" offerings. Over 63% of Ping An's nearly 234 million retail customers used services from the health and senior care ecosystem as of March 31, 2024. They held approximately 3.37 contracts and RMB57,600 in AUM per capita, 1.6 times and 3.6 times those held by non-users of these services respectively. Ping An made significant progress in customer development by effectively integrating insurance with health and senior care services. The Group's health and senior care ecosystem had over 45,000 paying corporate clients in the first three months of 2024. Ping An Health had nearly 40 million paying users over the past 12 months. Ping An achieved nearly RMB40 billion in health insurance premium income in the first three months of 2024. Customers entitled to service benefits in the health and senior care ecosystem contributed approximately 70% of Ping An Life's NBV in the first three months of 2024, up 6 pps year on year. Over 10 million customers of Ping An Life used services from the health and senior care ecosystem in the first three months of 2024. Notably, over 60% of Ping An Life's newly enrolled customers used health management services in the first three months of 2024. Ping An provided services via an "online, in-store, and home-delivered" service network by integrating domestic and overseas premium resources. The Company had about 50,000 in-house doctors and contracted external doctors in China as of March 31, 2024. Ping An partnered with over 36,000 hospitals (including all top 100 hospitals and 3A hospitals), over 100,000 healthcare management institutions and approximately 231,000 pharmacies (over 37% of all pharmacies, up by nearly 1,000 from the beginning of the year) in China as of March 31, 2024. Moreover, Ping An launched nearly 600 home-based senior care service items in 54 cities across China. Overseas, Ping An partnered with over 1,300 healthcare institutions in 35 countries across the world as of March 31, 2024, including eight of global top 10 and 54 of global top 100. Ping An continuously built leading technological capabilities, which have been widely utilized to empower its core financial businesses. The Group's patent applications led most international financial institutions, totaling 51,700 as of March 31, 2024. From the perspective of transforming and upgrading Ping An's core businesses, technology benefits are reflected in higher sales, better business efficiency, and stronger risk management. The volume of services provided by AI service representatives reached about 420 million times, accounting for 80% of Ping An's total service volume in the first three months of 2024. AI-driven product sales accounted for 58% of total product sales achieved by service representatives. Claims loss reduction via smart risk identification reached RMB3 billion. Ping An actively fulfilled its social responsibilities and furthered green finance initiatives. Ping An achieved RMB10,682 million in green insurance premium income and provided RMB2,677 million for rural industrial vitalization through "Ping An Rural Communities Support" in the first three months of 2024. Ping An received a "Low Risk" ESG risk rating from Morningstar Sustainalytics with a score of 17.0 in 2024, ranked first in the Chinese mainland's insurance sector. Looking ahead, China's economic fundamentals are improving, and the trend of economic recovery will remain unchanged. Ping An will maintain its strategic focus on core financial businesses, continue advancing its technology-driven "integrated finance + health and senior care" strategy. The Company will keep its business resilience, build its strengths, and continuously improve operations and management to promote business recovery and growth. The Company will continuously improve the quality and effectiveness of financial services for the real economy, contributing to China's development into a financial powerhouse.